To form a successful cross calendar strategy, you need clear trend direction indicators - price points that define positive and negative trends.

This strategy shines when trends develop rapidly, leaving traders uncertain about future direction. Consider January 2016's first week:

Using 1SD formula, we predicted Nifty uptrend starting at 8010 (target 8168) and downtrend at 7956 (target 7798), based on December 31st close at 7983.

On January 4th, Nifty opened gap down, hit 7798, and closed at 7808 - fully realizing our downtrend prediction on the first trading day.

This rapid trend exhaustion creates uncertainty, making cross calendar strategies ideal for capitalizing on short-term movements.

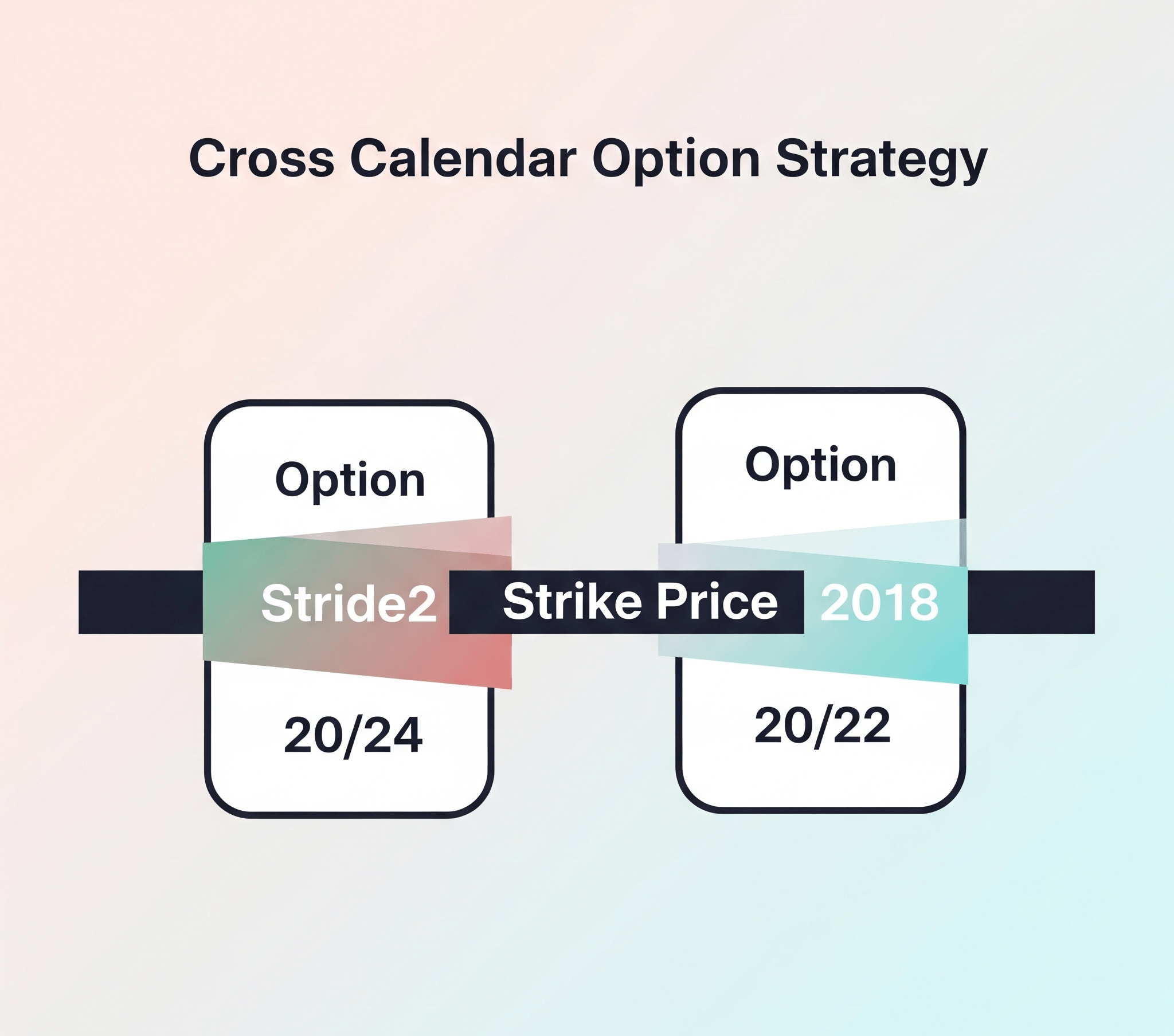

It combines long straddle/strangle in current month with short strangle in near month:

Buy Nifty 7800 CE + 7800 PE (January expiry) and sell 8000 CE + 7600 PE (February expiry).

This creates a cross calendar bull and bear spread that profits from volatility and time decay.

Requires understanding short-term trends and open interest patterns:

Step 1: Trend Identification

After January 4th close at 7808, we calculated:

Step 2: Open Interest Analysis

On January 5th observations:

Step 3: Strategy Execution

At Nifty 7790:

Fibonacci and 1SD trends provide key speculation points at 0.618 and 1.236 retracements:

Speculation Technique: When Nifty crosses 7877, close 7600 PE short and re-enter at 7851 (0.382 retracement). If price holds above 7946, close all positions profitably.

This "speculate without compromising profit" approach maximizes gains while managing risk.

Ratio spreads can also be effective in similar situations:

Buy 7800 CE + 7800 PE (1 lot each) and sell 7600 PE + 8000 CE (2 lots each) same month.

Apply similar Fibonacci-based speculation techniques.

Conclusion: Success in option strategies depends on accurate trend forecasting - the 1SD method provides exceptional reliability.