For optimal results in straddle strategies, focus on these two critical elements:

1. Identify the trend to determine long or short straddle 2. Calculate call/put deltas independently for delta neutralityStraddle and strangle strategies are popular among option traders for their simplicity and profit potential. However, many traders struggle with disappointing results. The issue lies not in the strategy itself, but in its implementation.

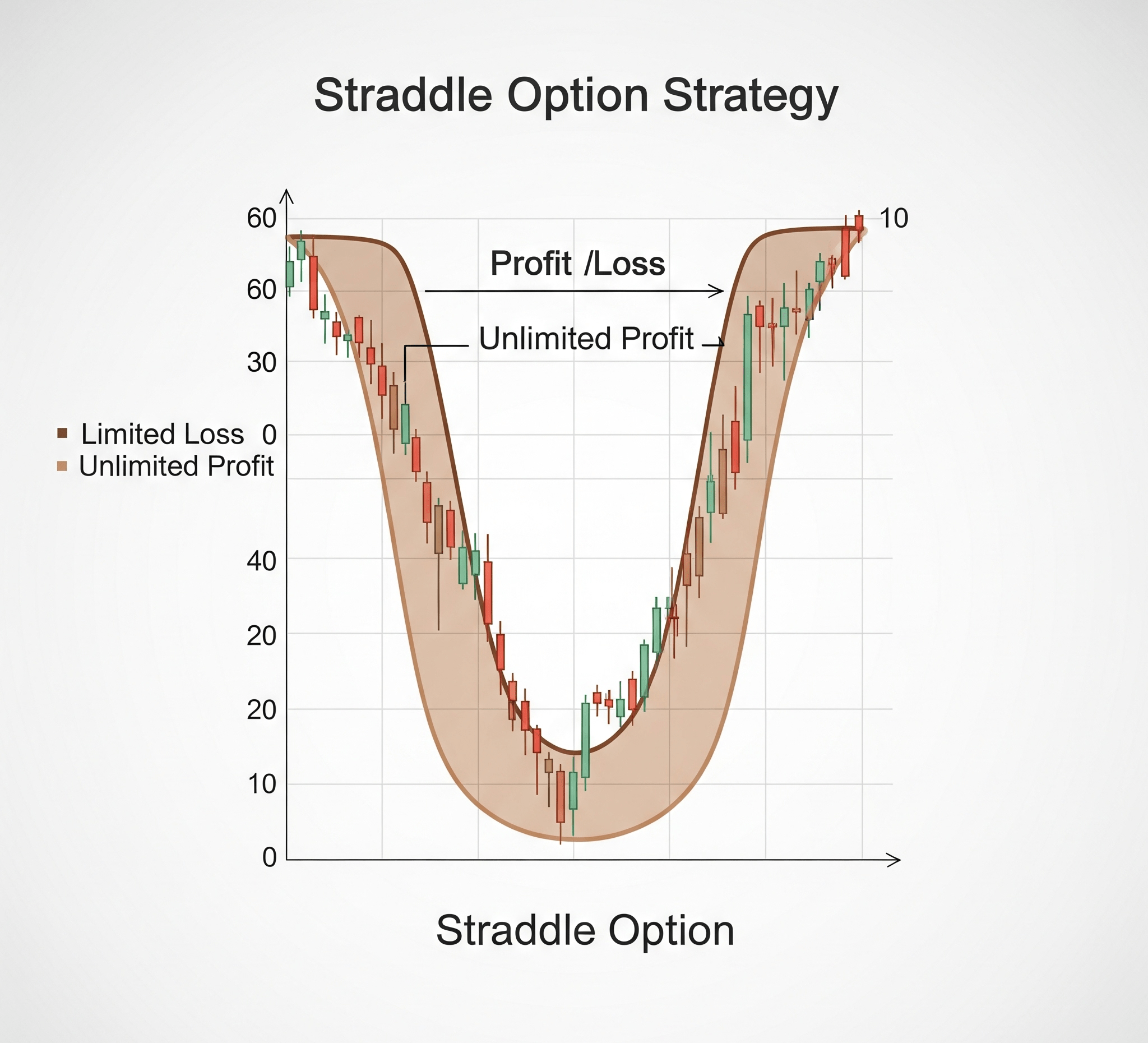

Long Straddle: Buying both call and put options at the same strike, underlying, and expiry.

Short Straddle: Selling both call and put options at the same strike, underlying, and expiry.

Long Straddle: Buy 7500 CE @₹50 + Buy 7500 PE @₹50 (Jan 2016 expiry)

Short Straddle: Sell 7500 CE @₹50 + Sell 7500 PE @₹50 (Jan 2016 expiry)

Theoretically, long straddle breaks even at 7600 (+100) and 7400 (-100). Short straddle profits between 7400-7600.

However, reality differs due to:

Using 1SD trend forecasting (proven most reliable):

| LTP | 7453 (28 Jan 2016) |

|---|---|

| 1SD Weekly Price Range | 123.85 |

| Fibonacci Trend Expectations | |

| 0.236 | 7482.23 / 7423.77 |

| 0.382 | 7500.31 / 7405.69 |

| 0.5 | 7514.93 / 7391.07 |

| 0.618 | 7529.54 / 7376.46 |

| 0.786 | 7550.35 / 7355.65 |

| 0.888 | 7562.98 / 7343.02 |

| 1.236 | 7606.09 / 7299.91 |

| 1.618 | 7653.4 / 7252.6 |

Trend Analysis: Uptrend starts above 7482, downtrend below 7423. Maximum expected move: 171.17 points.

With 7500 CE @113 and 7500 PE @159 (total 272 points), long straddle is not advisable. Short straddle may work but carries risk if price moves beyond 7653/7253.

Standard models assume put delta = call delta - 1. We differ because:

Nifty Feb 25 expiry @7453

7500 CE: 113 (IV 13.72%, delta 0.5185)

7500 PE: 159 (IV 19.46%, delta -0.47899)

Net delta: 0.5185 + (-0.47899) = 0.03951

Delta-Neutral Adjustment: For 10,000 call quantity (delta 5185), need 10,825 put quantity (delta -5185) to neutralize.

Nifty lot size = 75, so 133.33 lots call options would require ~144.33 lots put options.

For straddle success: